By Neo4j Graph Database Platform -

2020-12-21

By Neo4j Graph Database Platform -

2020-12-21

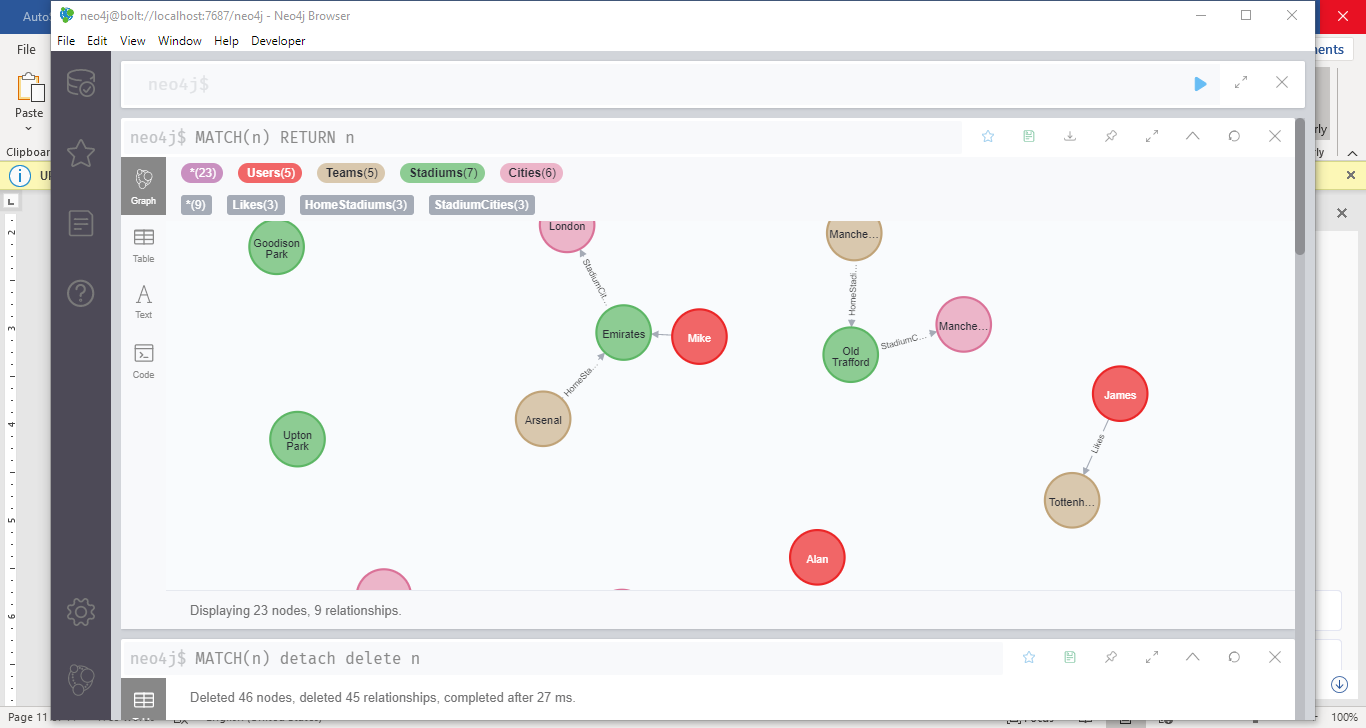

Read this blog to find out how graph data platforms empower you to take full advantage of for today's connected data.

By Neo4j Graph Database Platform -

2021-01-18

By Neo4j Graph Database Platform -

2021-01-18

Discover how you can tap into the power of graph databases for sophisticated fraud detection to catch criminals in real time.

By Neo4j Graph Database Platform -

2020-12-30

By Neo4j Graph Database Platform -

2020-12-30

Here are all the biggest Neo4j news stories from 2020, including new releases like Neo4j 4.0 and the Graph Data Science Library to the FinCEN Files coverage.

By Neo4j Graph Database Platform -

2015-12-23

By Neo4j Graph Database Platform -

2015-12-23

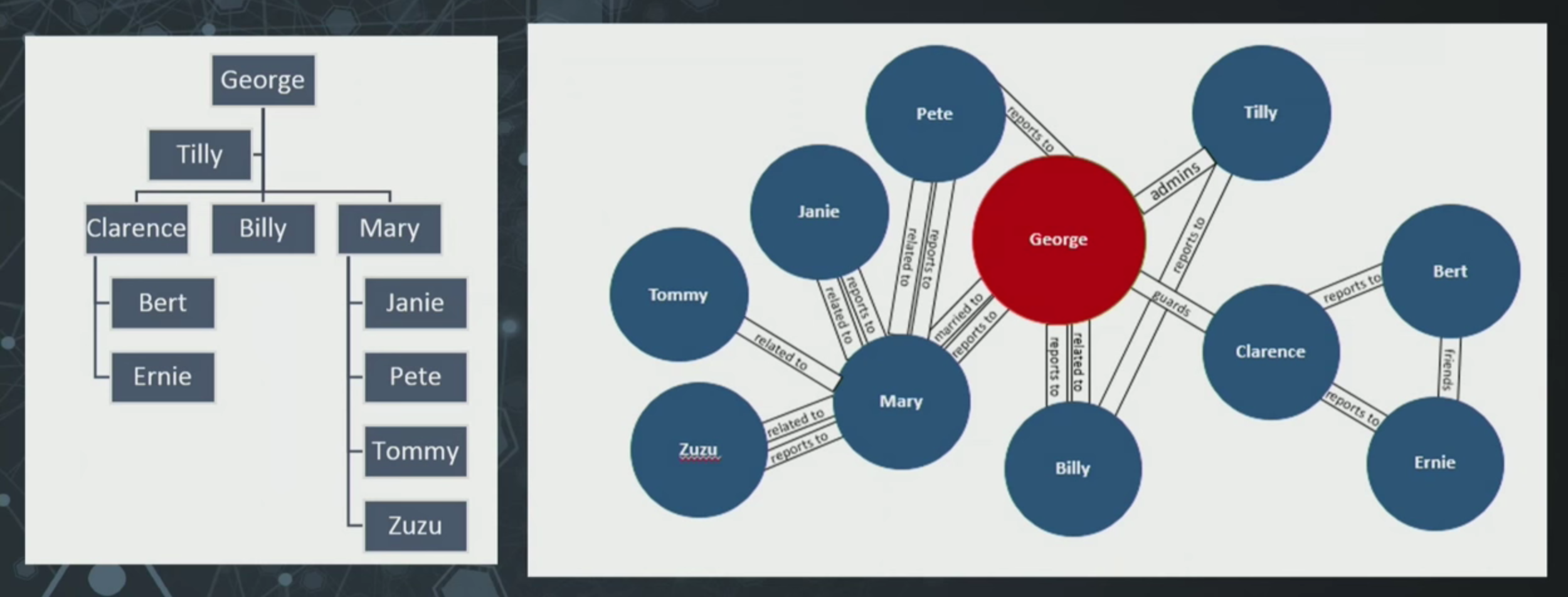

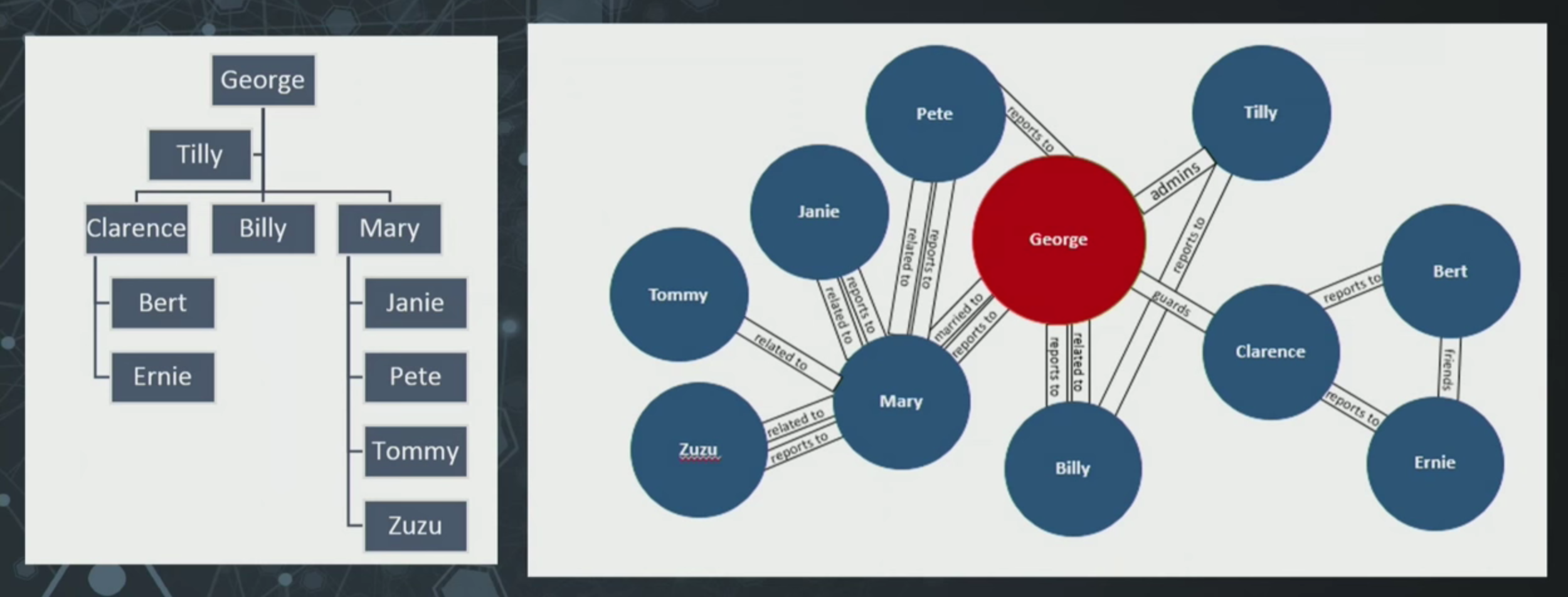

Watch (or read) Senior Project Manager Karen Lopez’s GraphConnect presentation on the signs that your data is actually a graph and needs a graph database.

By diginomica -

2020-09-24

By diginomica -

2020-09-24

How do you work backwards from thousands of disconnected PDFs to the 100,000 suspicious financial transactions they’re reporting on? A combination of hard human work, OCR, data analysis and graph.

By Medium -

2019-05-15

By Medium -

2019-05-15

Many graph algorithms originated from the field of social network analysis, and while I’ve wanted to build a twitter followers graph for a long time, the rate limits on its API have always put me…